AI in Insurance Sector. How Is Artificial Intelligence Transforming the Insurance Industry?

Inside this article:

Artificial intelligence is gradually making inroads into every industry, and the insurance sector is no exception. It is a complex and highly regulated industry that has been slow to adopt new technologies until now. AI technology has already begun to transform the way insurers do business by helping them become more efficient and effective. This article will discuss how AI is changing the insurance industry and how companies can benefit from it. We will take a look at some of the ways AI is being used in the insurance industry and how it is helping insurers and policyholders alike.

AI in Insurance Sector

When thinking about the insurance sector, innovation is definitely not the first that comes to mind. In recent years, AI has been gaining momentum in finance and logistics, but the insurance sector seems indifferent to its potential. However, things are changing, and the insurance companies embrace the opportunities this technology opens up for them. And these are impressive, benefiting both the companies themselves and their clients.

Customers often associate the insurance sector with the tons of paperwork, time-consuming meetings, filling complicated claims, and waiting long months for a decision. The AI allows the insurance companies to radically change that image, adjusting the service to XXI century standards while maintaining high transparency. That can save the customers some worries and increase their trust towards the insurance provider. At the same time, companies can use AI to stimulate their business growth, lowering the risks and automating various processes to reduce the overall costs.

How AI Is Transforming the Insurance Industry

AI allows insurance companies to keep up with the changing market realities and adjust to the evolution of the sectors they have close ties with – particularly automotive.

The revolution brought by autonomous vehicles makes many insurance companies change how they think about their own future. AI-driven cars will most likely change the character of the claims. They will be less frequent due to the lower number of accidents - however, once they happen, the customers will need higher remuneration due to the complexity of the vehicle. With AI, insurance companies can build platforms that process real-time data for prevention purposes and automate a big part of insurance executives’ responsibilities, including data processing, fraud detection, and claim estimation. Because of that, in the future, the role of insurance agents could drift towards emotional support.

Artificial intelligence will also lead the insurance companies towards progressive digitalization of their services. Compared to other sectors, the insurance one still relies heavily on paper documentation and in-person meetings. That’s problematic for clients that need immediate insurance or claim payment while, for example, being abroad. The digital platforms based on AI solutions solve that issue, enabling remote verification and claims processing securely for both parties.

Last but not least, artificial intelligence is and will continue to transform the customer experience. Some companies, like US-based Lemonade, already turn their services 100% digital, providing their clients with mobile apps handling claims with zero paperwork.

Are you wondering how does it look in practice? Based on the use cases, we’ll break down practical applications of AI and machine learning in the insurance sector, taking a closer look at the challenges and opportunities brought by such transformations.

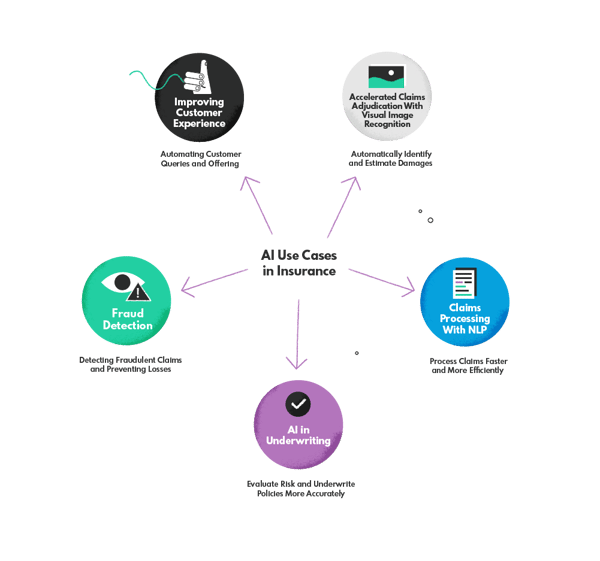

AI Use Cases in Insurance

There are three fundamental areas in which artificial intelligence tools can revolutionize the insurance industry: claims processing, risk assessment, and forecasting. We’ve gathered the examples of its applications below to capture its full potential.

Fraud Detection – Detecting Fraudulent Claims and Preventing Losses

Frauds are becoming more and more sophisticated these days, and their detection is one of the biggest challenges the insurance companies face. The most common fraudulent claims in the car insurance sector include false reports of stolen vehicles, fabricated car accidents, or inflated auto repair costs. Health insurance fraud is when a claimant alters medical bills or fills claims for services that haven’t been received.

In a traditional model, the whole process of verifying the claims would be the responsibility of the insurance agents. Even those with a long-time experience in the industry may struggle to detect frauds, particularly the less common ones. Here’s where the AI comes into play with its pattern-detection potential. Since fraudulent claims are generally rare in relation to their total number, machine learning engineers tend to use logistic regression models for their detection. They can identify patterns most efficiently. AI allows the examination of large data sets to identify patterns that would otherwise be invisible to humans. This helps insurers stop fraudulent claims before they even happen, saving the company a lot of money.

If you would like to get a deep insight into this process, check our case study documenting the implementation of AI for fraud detection in the auto insurance company. It lays out all the necessary steps, from data collection to model training and pattern detection, and describes how we approached such challenges as a high dimensional dataset and a low number of fraud incidents necessary to identify the patterns.

Related case study: Auto Insurance Fraud Claim DetectionAn insurance firm reached out to nexocode with a challenge of identifying fraudulent claims linked to communication accidents. They wanted us to create a fraud detection algorithm that would immediately identify automobile insurance fraud claims and process them instantly.Our challenge? Identifying fraudulent claims for auto insurance with machine learning model build on historical data. Our anomaly detection AI model analyzes car insurance claims immediately upon submitting claim forms. It then calculates the claim’s fraud score and then notifies fraud analysts to take a look at the fraud-flagged claims. The model was trained on various road traffic accidents claims and additional documents the insurance company has on their clients to help the fraud detector understand the class distribution of reports that are fraud and which ones are real. With the help of AI, insurance agents can bring operational efficiency and limit the number of wrongly paid claims and reduce the amount of total claims payments. Read more about this case study.

AI in Underwriting – Evaluate Risk and Underwrite Policies More Accurately

Insurance is a risky business – and artificial intelligence can help identify these risks, accelerating the underwriting process. Instead of relying on in-person interactions in risk assessment, the insurers can engage machine learning algorithms to determine the risky behaviors among the potential policyholders. The risk premises can also be identified via data extracted from communication, like e-mails, with the help of natural language processing.

For that purpose, the model is first trained for pattern detection with an extensive dataset containing historical customer data. To achieve the most accurate results in predictive analytics for underwriting purposes, it’s worth reaching out to neural networks that provide better accuracy than linear regression models (if only the dataset is large enough).

Aside from identifying risk factors when underwriting policies, insurance companies can also use predictive modeling for dynamic pricing. The predictive models help them modify the prices according to the current situation on the market, as well as the customer behavior.

Claims Processing With NLP – Process Claims Faster and More Efficiently

Traditional insurance claims processing is a time-consuming process involving a lot of paperwork. It requires the experts to look through numerous documents to verify the customer’s accountability and claim validity. That makes risk evaluation and fraud detection much harder, even for the most experienced insurance executives in the industry. Plus, it’s simply ineffective since there are technologies that can process these documents, allowing the insurance executives to focus on more demanding but less labor-intensive and repetitive tasks.

Using natural language processing (NLP), insurance companies can process claims faster without compromising their security. Statistic-based NLP algorithms extract knowledge from the language-based documents, identifying and classifying information using taxonomies and ontologies that later will serve for better interpretation. NLP helps insurance companies to organize data and summarize information delivered in particular documents, saving the actual decision-makers a lot of work.

Accelerated Claims Adjudication With Visual Image Recognition – Automatically Identify and Estimate Damages

Video processing is helping many industries make their verification processes more efficient, and the insurance sector is no exception. In its case, this AI-based technology is used not to detect anomalies and defects to maintain quality or prevent downtimes but rather to verify the claims.

Typically, the insurance agent would have to appear on site and verify the damages that have occurred during an accident, natural disaster, or any other event. That would make the claims management drag along, extending to even a few weeks. Visual image recognition shortens this process since it becomes partially automated and fully remote.

AI and machine learning can be used to estimate the cost of repairs when you are filing a claim for your car or house. AI will use computer vision algorithms to determine the extent of damage in photos uploaded by users. AI is also capable of estimating the cost of damages based on past claims and data sets. For auto insurance, they estimate repair costs by considering various factors such as the make and model of the car, the age of the vehicle, where the vehicle is located, and other variables. By doing this, AI can help insurance companies save money on claims management by accurately predicting the cost of repairs.

It’s enough that an insured individual provides the insurance company with pictures of the accident. The algorithm trained with labeled training data will interpret the image previously broken down into pixels, identifying the damaged component first and then recognizing the damage type using visual pattern recognition. That’s the first step to repair costs estimation – unless it turns out that the damage is fabricated or it doesn’t entitle the insured person to the claim payment. Note, however, that this process has a human component to it. The final decision is usually up to the insurance agent - the algorithms just pave their way towards it.

Improving Customer Experience – Automating Customer Queries and Offering

Customers are getting used to automated processes across industries, appreciating the time saved this way. With finance or e-commerce companies pampering them with innovations, they’re starting to expect the same from the insurance providers. It’s worth meeting these expectations before it becomes a standard to win some market advantage.

It doesn’t mean that you should go all in and release a mobile app that will reduce the claim submission to a few simple steps and shortens claim payment time to a few seconds (although we recommend it, considering the rise in mobile traffic in recent years!). You can start by automating customer queries, providing the users with access to chatbots that will solve the typical issues, delegating the most complex ones to real-life consultants.

What Are the Benefits of Artificial Intelligence in the Insurance Industry?

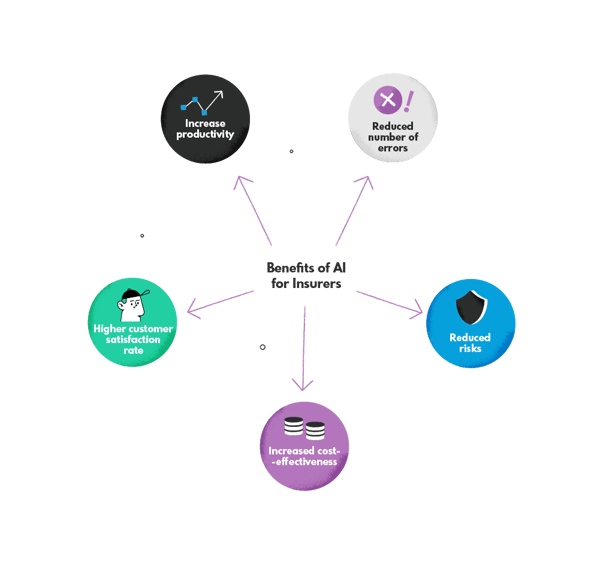

As we’ve mentioned before, the adoption of artificial intelligence by the insurance company is a win-win (if only done right). Both the insurers and the insurance customers benefit from it at multiple levels.

Advantages of Applying AI for Insurers

By applying AI, the insurance company can reduce the probability of errors that compromise its financial security. Manual verification of the claims (including the filled documents and photographs) is error-prone, time-consuming, and ineffective - the artificial intelligence tools can take over the central part of this process, allowing the insurance agents to focus on more complex and creative tools.

In a nutshell, AI’s application results in:

- increased productivity

- the higher customer satisfaction rate

- increased cost-effectiveness

- reduced risks

- reduced number of errors

Benefits of Applying AI for Policyholders

Most of all, artificial intelligence improves the policyholders’ customer experience. Chatbots can answer their questions 24/7, and the ML algorithms – process their claims instantly instead of passing through a time-consuming manual verification.

Summary - The Future of Insurance Lays in Machine Learning

Artificial intelligence is transforming the insurance industry by automating customer queries and claims processing. AI benefits insurers by reducing the probability of errors, while policyholders experience improved customer service. In the future, AI will play an even more significant role in the insurance industry, providing further advantages to both insurers and policyholders.

The use cases above should give you an overview of AI’s possibilities in the insurance sector. Would you like to see how your particular product can benefit from its implementation? Every project deserves an individual approach – reach out to us to consult yours. We can provide you with our AI expert consulting and contribute to its practical model implementation.