AI in Banking. Applications and Benefits of Artificial Intelligence in Financial Services

Inside this article:

Artificial intelligence is present in every industry, and the banking sector is no exception. Banks and fintech companies are under pressure to adopt new technologies to remain competitive. AI can help financial services firms automate processes, increase efficiency, reduce costs, and improve customer service. The banking industry is already using AI for such tasks as predictive modeling, fraud detection, NLP, visual image recognition, and many others. By investing in machine learning solutions, financial organizations can gain a competitive edge over their rivals.

This article will discuss various applications of AI in banking and financial services. We will also highlight the benefits of using machine learning solutions in this sector.

How Is AI Changing the Banking Industry?

The banking sector has undergone a spectacular digital transformation in recent decades. That may be surprising considering the fact that financial institutions are associated with rigid approaches and stiff structures, mainly due to questions of security. However, looking at things globally, they’ve made significant progress in no time. Who would have thought that we will be able to pay for our groceries without bringing a card or even a mobile phone within the two decades from the introduction of contactless payments? Or carry out the international transfers in a few seconds, without any central unit acting as an intermediary between the parties?

Many of the changes in banking are a result of AI’s development – and with time, artificial intelligence tools will be responsible for an increasing number of processes in banking institutions and apps. The impact of AI is clearly visible in various areas of the sector, from decision-making processes, through forecasting, to customer experience.

Interestingly, while some Western countries didn’t embrace these opportunities, others – including the countries of the former Eastern Bloc, like Poland or Estonia – have become the leaders of innovation in banking. In recent years, their financial institutions have introduced innovative tools and strategies in their mobile apps and customer service, setting new European or even global standards.

At this point, there’s no way back – both the companies and their clients have grown used to the convenience provided by the AI tools. Most likely, the banking sector will continue to embrace the potential of artificial intelligence, particularly in the fields of fraud detection and decision-making, combining it with other innovative technologies like Blockchain, which has been gaining momentum in finance. Will the market pick all the most recent AI-based solutions, like controversial facial recognition for payments? Time will tell – but undoubtedly, artificial intelligence will continue changing the face of the industry, fuelling a customer-first attitude.

Applications of Artificial Intelligence in the Financial Services and Banking

Similar to other industries, the applications of AI in banking are either internal or external. On one side, artificial intelligence tools streamline the processes within the organization (including decision-making) and increase its security, which is a crucial aspect of banking services. On the other hand, AI technologies have a positive impact on the quality, speed, and accuracy of banking services, improving the customer experience as a result.

In order to outline all the spectrum of possibilities artificial intelligence provides for the banking industry, we’ve gathered the most common use cases, breaking them down to the smallest detail.

Personalized Banking Services

Personalization is a powerful tool in all industries, particularly where the customer experience has a crucial impact on market success. No wonder banks have started taking advantage of it to increase the competitiveness of their services. In the end, the bank products are relatively standardized – it’s hard to stand out with the offer itself or with the prices. In such a landscape, personalization becomes the institution’s secret power, allowing to adjust the communication and offer to the preferences of a particular customer, and increasing the chances of conversion as a result.

With their recursive learning capabilities, the machine learning algorithms can gather customer data and process it for personalization purposes, increasing its accuracy over time. Prescriptive personalization takes advantage of the historical data to create optimized workflows. In contrast, real-time personalization involves both historical and real-time data to develop personalized recommendations and customize the virtual assistant’s support based on natural language processing models.

The customers like to feel unique and heard – and the AI-fuelled personalized virtual assistants provide them with that sentiment. Thus, it’s a perfect way to create trust and activate the users while reducing their effort at the same time. Personalized video assistants can also collect data via interactive elements. This data can later serve for further customization or improving the existing services.

Fraud Detection

Lately, you may have heard a lot about Blockchain concerning fraud prevention. And indeed, the transparency and immutability of the blocks within the blockchain network make fraud much less likely to occur. However, to detect it successfully, financial firms have to involve machine learning-based tools. Of course, you can mingle the two for the best results!

Banks can incorporate unsupervised algorithms in their systems for the purposes of fraud detection. Trained with historical data, they identify unusual patterns, speeding up the review process and taking over a part of the human duties. Manual verification is still critical – however, the algorithm can complement it by preselecting the anomalies that will be verified by a real-life expert in the further steps. This way, leading financial institutions that rely on key fraud detecting applications cut the costs of the fraud detection-related operations and increase their effectiveness, reducing the probability of human mistakes.

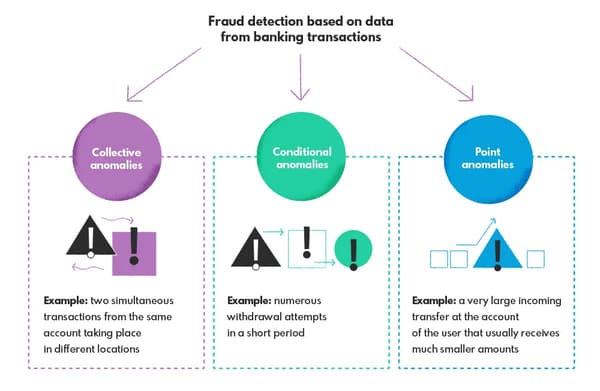

The machine learning algorithms can identify various fraud patterns in banking transactions:

- collective anomalies (example: two simultaneous transactions from the same account taking place in different locations will be identified as fraudulent transactions)

- conditional anomalies (example: numerous withdrawal attempts in a short period)

- point anomalies (example: a substantial incoming transfer at the account of the user that usually receives much smaller amounts)

Building an effective ML model for fraud detection (usually based on logistic regression that enables effective classification of the suspicious actions, but sometimes also KNN or Naive Bayes) takes time because of the broad range of possible anomalies and noise, often leading to numerous false positives.

Of course – it’s safer to detect falsely suspicious activities than skip those that could be potentially fraudulent. Nevertheless, it gives the manual verifier a lot of additional work. This issue can be solved by implementing a secondary analysis that will prioritize the actions to review.

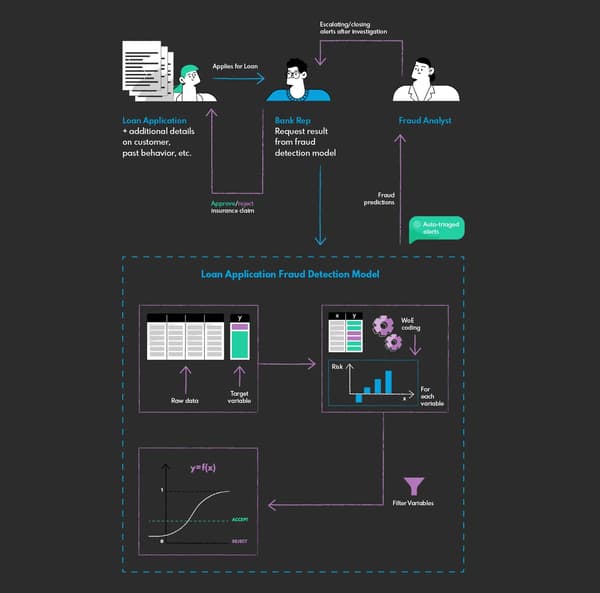

If you’d like to understand better which challenges can the ML engineers encounter when developing and implementing such models, check our take on the fraudulent loan applications-identifying system.

Related case study: Loan Application Fraud DetectionA company from the finance sector approached us with a significant problem - they wanted to develop an AI model that could help them make smarter underwriting decisions and faster approval process by automatical identification of fraudulent loan applications.Our challenge? Identifying fraudulent loan applications manually is challenging because of the substantial volume of cases to be reviewed each day. Fraudulent applications take a long time to detect and even longer to deny, resulting in more significant revenue loss. The challenge was to create a predictive analytics model that could sift through all loan applications and sort out the probable fraudulent ones from the genuine ones within minutes. Read more about this case study.

Loan Risk Assessment and Credit Scoring

Using supervised learning (mainly logistic regression models), the banks can automate their loan risk assessment process and credit scoring, making the processing of the loan application much faster and more effective.

The statistical models analyze the demographic and behavioral data to assess loan risks and provide credit decisions. Aside from such data as age, address, monthly income, home status, or employment length, the algorithm can consider other risk-defining information such as consumption habits. The potential lender will receive a credit score that serves as a basis for the decision-making process.

Banking institutions can train the algorithms with historical data of the customers that failed to pay off the loan and those who didn’t. They learn to identify patterns that imply possible default, enabling more accurate risk assessment. If account history shows risk-implying patterns (such as lack of regular savings, big expenses, irregular incoming transfers), the algorithm will treat them as red flags. And analogically, if the patterns imply reliability, the customer will have more chance to qualify for a loan.

To get to know more about our approach for default prediction and the challenges we have faced when implementing the predictive model for this purpose, read our case study.

Aside from default risk, predictive algorithms can also estimate the interest rate risk and prepayment risk, which are essential variables in loan underwriting. Since these two variables are strongly correlated with the market situation, the financial institution will need to involve powerful unsupervised deep learning algorithms and feed them with extensive historical market data so that they learn to estimate possible risks in the future.

Predictive Modeling to Maximize Bank Incomes

Banks use predictive modeling to identify potential risk in a loan underwriting process and fraud detection, but that’s not where the possibilities end. Many institutions reach out for it to maximize sales by improving the efficiency of cross-selling. The predictive models can learn with existing customer behavior data to come up with more relevant cross-selling offers for a particular client. With a thorough segmentation of the dataset and market basket analysis, the suggestions may become even more accurate, making sales skyrocket.

Related case study: Predicting Bank Loan Defaults for Profit MaximizationA company from the fintech industry wanted to develop an AI model that could predict bank loan defaults in order to use the information for profit maximization.Our challenge? nexocode developed an AI system based on credit history and other data points for loan default prediction to enable automated loan eligibility assessment and to identify risks of client defaulting with loan payments. As banks gain additional interest rates from clients late with their installments, so the credit decision based on machine learning model was optimized for increased revenue. Read more about this case study.

AI can be useful also in another industries, you can read our case study about auto insurance fraud claim detection here.

Facial Recognition for Frictionless Payment

Finally, we get to discuss one of the most controversial applications of AI in banking – facial recognition for payment purposes. Such systems may not yet be popular in Europe, but countries like China have been using them for some time already. Facial recognition payments are widely available in China in self-service stores or restaurants (for instance, KFC). Their systems process such payments, associating it with a customer DNA to track the client’s preferences and provide them with more accurate recommendations every single time.

This computer-vision-based technology is relatively simple – the payment terminal scans your face, sending its template to the interpreting device that compares it with the verified template from your bank. The process takes a few seconds and provides the customer with a new level of convenience since the transaction doesn’t require a mobile phone or a credit card. However, it remains controversial since it creates a potential field for mass surveillance.

Improved Customer Service

We’ve already mentioned that personalization can impact customer experience in a positive way. The virtual assistant is the best example. After authenticating the client’s identity using advanced techniques like voice biometrics, the VA analyzes the account details and demographic and behavioral data to stay one step ahead and provide the most accurate solutions.

This way, the customer doesn’t have to get into the details, saving precious time. Based on the data check performed within a matter of seconds, VA can recognize the possible cause of the inquiry. Even if it’s a miss, the conversion rate may still rise due to personalized suggestions created based on customer data. Here’s an example: looking through the most recent account history, the virtual assistant registers multiple foreign transactions on a customer account, associating them with a possible international journey. Thus, it suggests a free cash-withdrawal service all over the world. The customer actually came with a different issue, but since the withdrawals have cost them quite a lot, they find this service useful and buy it.

The personalized virtual assistant can solve issues of different complexity – and much more! They may book appointments with real-life consultants by connecting with the CRM or issue and process documents. If necessary, VA may even process requests for external services, for example, filling insurance policy requests.

Automation of Backoffice Processes with RPA and NLP

The applications listed above may be spectacular, but let’s not forget that artificial intelligence supports the banking institutions behind the scenes, too. With Robotic Process Automation(RPA), banks can engage bots to automate repetitive, labor-intensive, and human error-prone processes like invoice and payment processing. As a result, their expenses decrease, the productivity reaches peaks without hiring additional staff, the number of errors in invoices falls, and the execution of the processes becomes lightning fast.

RPA enables banks to issue numerous invoices instantaneously and schedule their sending. At the same time, it may serve for payment review, securing billing, and streamlining collections. With natural language processing (NLP), the bots can extract information and capture knowledge from documents in order to facilitate application processing and decision-making. As banking is documentation-intensive per se, such innovation makes quite a difference.

You can read more about various use cases of NLP in banking and financial services in our recent article.

The Benefits of Using AI in Finance

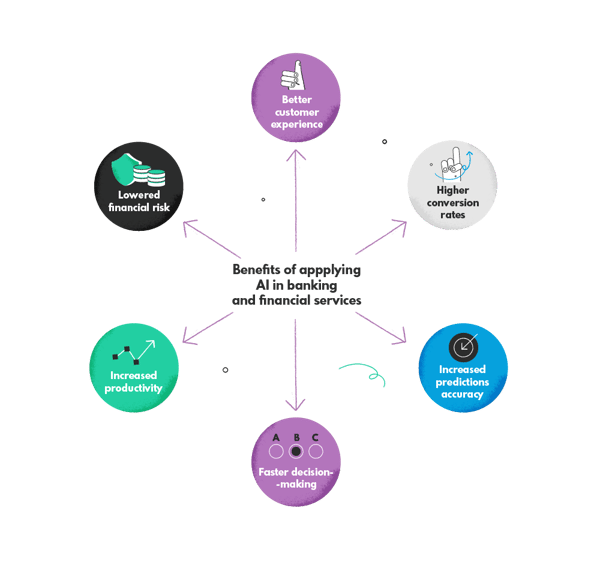

Artificial intelligence streamlines internal and external processes of the banking institutions, cutting costs, increasing productivity, and ensuring safety.

Banks can take advantage of AI’s potential in loan risk assessment, replacing the traditional methods with those powered by machine learning to detect patterns that the human eye may not grasp. This way, the borrower gets the decision faster, and the lender saves time and money spent on the manual review process, ending up with the most accurate credit scores based on relevant, real-time data.

At the same time, many banks can apply AI solutions in their mobile banking apps or on their websites to strengthen the bond with the customer, increase their satisfaction with the service, and grab their attention with personalized communication that fuels sales. All while reducing customer service costs thanks to automation.

How to Gain a Competitive Edge With AI?

The AI’s time is now, and it’s worth embracing its possibilities ASAP – but only after a thorough analysis of the company’s structures and processes. That will help you identify potential areas for improvement and introduce artificial intelligence tools that actually fit your business model. We cannot provide you with a universal formula – but knowing your project’s specifics, we’ll be able to suggest the most suitable AI solutions. Reach out to our AI experts to tell us more about your idea!