Process & Story

Fraud is a highly complex situation when it comes to insurance companies because there’s so much at stake. Fraud can not only cost the insurance company a lot of money, but it can also cause people’s car insurance rates to increase. The manual process of reviewing auto insurance claims requires engaging highly experienced fraud reviewers, which makes identifying fraud time-consuming, costly, and not scalable with inflating insurance claims volume.

Problem

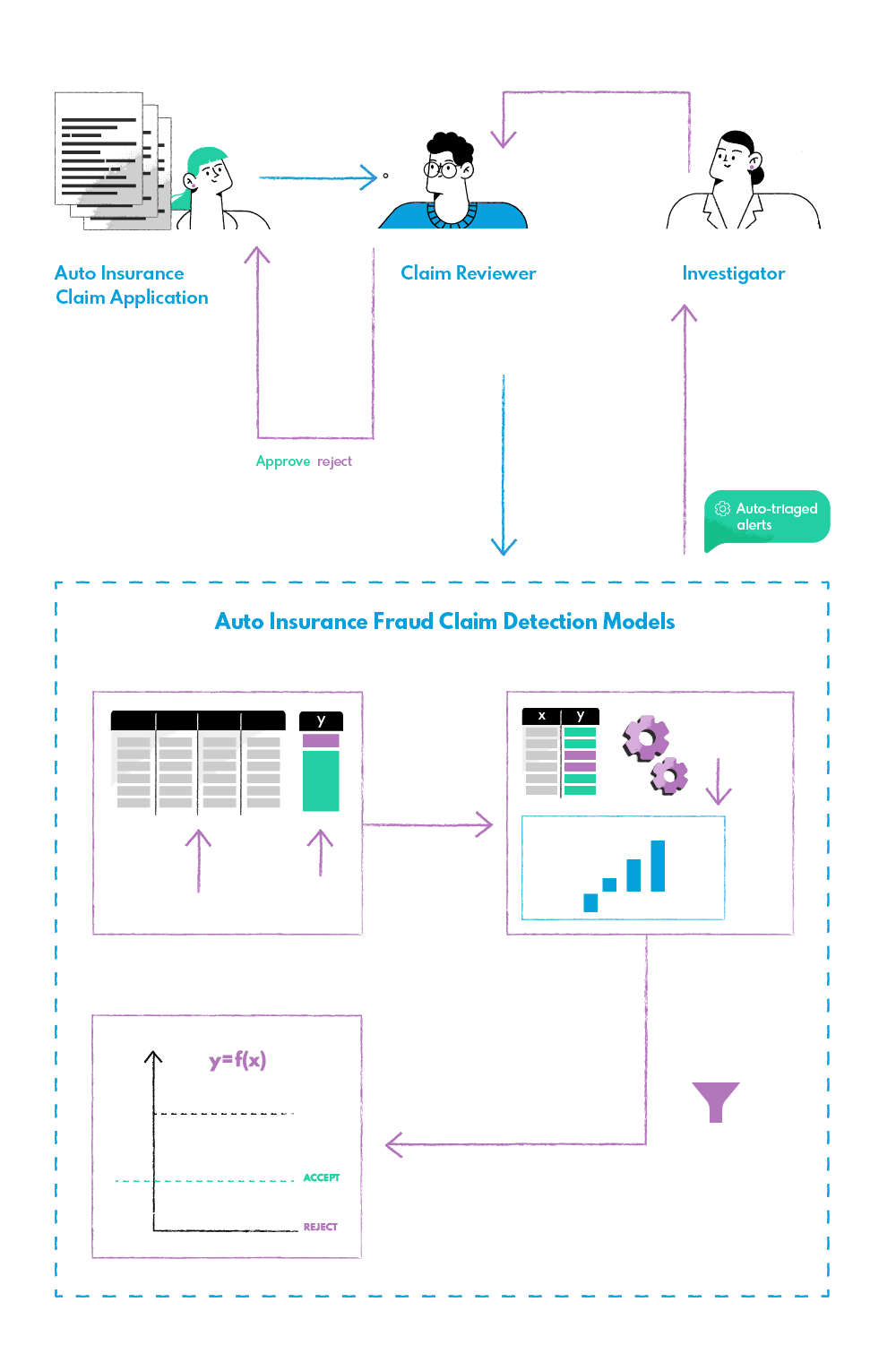

Our client, an insurance company, reached out to us with a problem of detecting fraudulent claims behind communication accidents. They wanted us to develop a fraud detection algorithm that would automatically flag auto insurance fraud claims and handle them in a way that human fraud analysts would approve or deny the claim after review.

Auto insurance fraud includes everything from falsifying facts on insurance applications, submitting false reports of stolen vehicles, nonexistent injuries, or damage to fabricating accidents, and submitting claim forms for incidents that never occurred.

Solution

Our Data Scientists conducted Exploratory Data Analysis (EDA) and went through dozens of these files to understand how fraudsters mimic legitimate auto insurance claims. Many false claims that we looked into had similar characteristics, which enabled automation of the currently manual claims review process.

We developed an AI model for insurance claims fraud detection using the logistic regression model. This statistical model identifies data points that are outliers, or anomalies, with respect to a more general dataset pattern. Because fraud is generally rare for most car insurance policies, the logistic regression approach can be used to flag fraud claims without losing too many legitimate claims along with it.

Our anomaly detection AI model analyzes car insurance claims immediately upon submitting claim forms. It then calculates the claim’s fraud score and then notifies fraud analysts to take a look at the fraud-flagged claims. The model was trained on various road traffic accidents claims and additional documents the insurance company has on their clients to help the fraud detector understand the class distribution of reports that are fraud and which ones are real. With the help of AI, insurance agents can limit the number of wrongly paid claims and reduce the amount of total claims payments.

With the fraud detector developed, the company from the insurance industry felt confident that they would significantly reduce fraud for their clients and save more money from fraud-related expenses.